Why Service Business Owners Need to Regularly Check the Sales Transactions Page

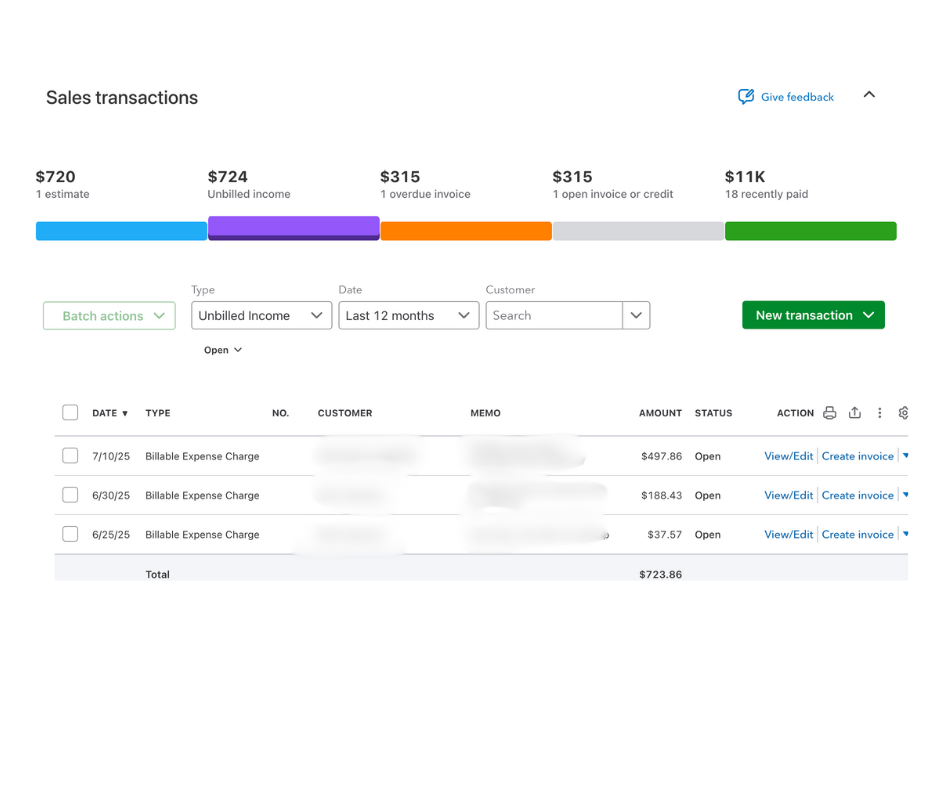

As a service-based business owner, staying on top of your finances is more than just checking your bank balance—it’s about understanding where your money is coming from and what’s still owed to you. One of the most overlooked tools in your accounting software is the Sales Transactions page, especially the Unbilled Income filter.

At Scoville Bookkeeping Solutions, our virtual bookkeeping service often uncovers thousands of dollars in unbilled income simply because business owners aren’t regularly reviewing this section.

What is Unbilled Income?

Unbilled income refers to services you've already provided but haven’t yet invoiced. This can happen when time tracking, delayed invoicing, or project-based billing gets overlooked. If left unchecked, it can lead to cash flow issues and missed revenue.

Why the Sales Transactions Page Matters

The Sales Transactions page gives you a comprehensive view of all your customer-related activity. By applying the Unbilled Income filter, you can quickly identify:

Services that have been delivered but not invoiced

Billable Expenses that have not yet been put on an invoice

Projects that need follow-up

Opportunities to boost cash flow with timely billing

How a Virtual Bookkeeping Service Can Help

A professional virtual bookkeeping service like Scoville Bookkeeping Solutions ensures that your books are not only accurate but also optimized for profitability. We regularly review your Sales Transactions page, flag unbilled income, and help you turn it into real revenue.

Pro Tip: Make it a habit to check the Unbilled Income filter weekly—or better yet, let us do it for you.

Need help uncovering hidden income in your books? Contact Scoville Bookkeeping Solutions today and let our virtual bookkeepers make sure you’re getting paid for every dollar you’ve earned.